Coauthored by Stella Lu

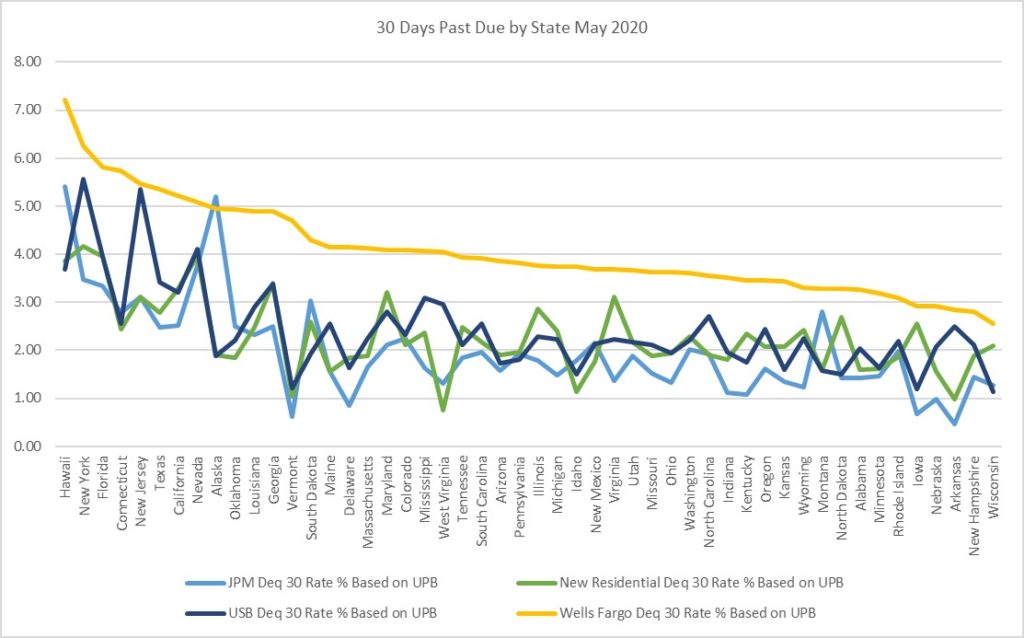

Wells Fargo delinquencies are to be higher than their peers across essentially all states. Below is a summary of the top three servicers (JPM/NewRez/USB) versus Wells Fargo based on the May 2020 data.

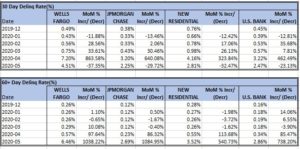

The Roll Rate Performance MoM for the Top Servicers shows a similar trend:

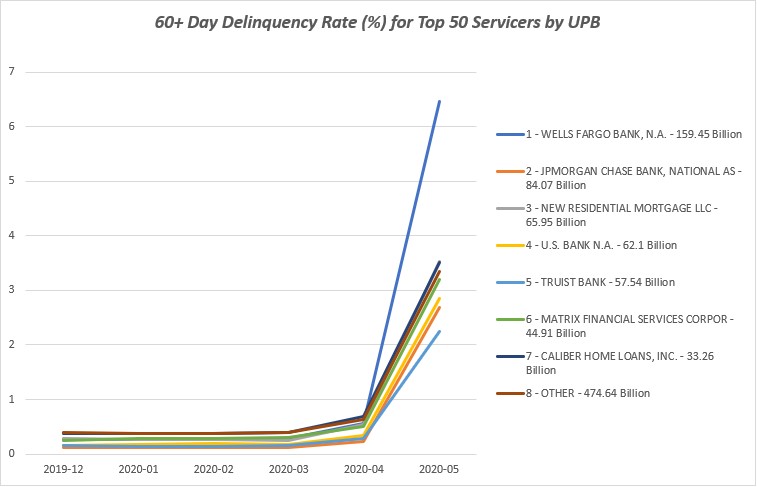

While the 30-day delinquency rate had been stable across all servicers, a slight uptick was experienced in March, followed by a significant uptick in April driven by COVID related delinquencies. Similar performance was experienced by the 60+ day delinquency rate. However, the 60+ % increased exponentially from April to May – due to April’s 30 day delinquencies rolling into the 60+ day bucket.

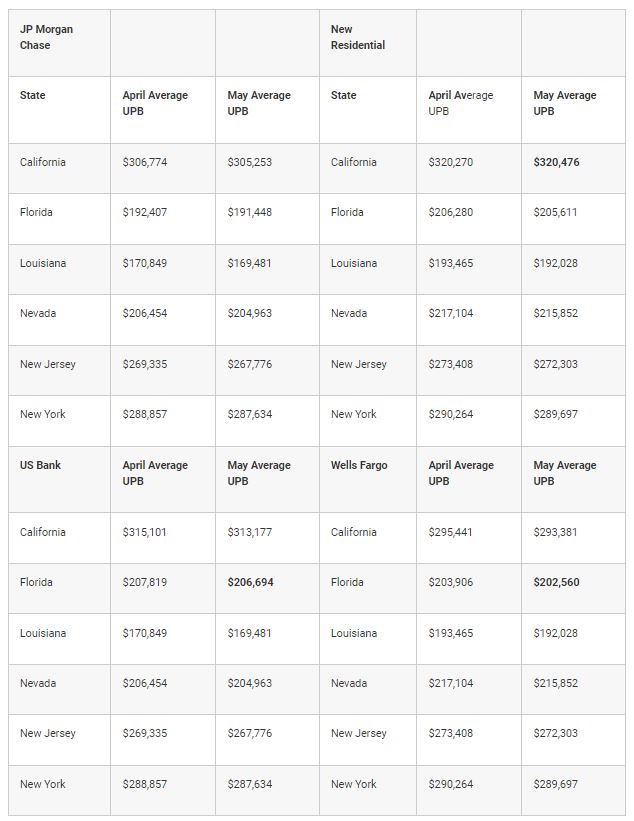

Wells Fargo and JP Morgan Chase experienced the greatest percentage increase, Wells Fargo 60+ % was 1.8 to 2.4 times the levels experienced by the other top services. What is the driver behind Wells Fargo higher than their peer’s delinquency performance? To confirm that loan size was not a driver, we examined the average unpaid principal balance for the top servicers and did not find major variances across the top servicers.

According to the RMBS Credit Indices: June 2020 provided by Kroll Bond Rating Agency, the 30+ day delinquency rate across the high and low LTV CRT indices was between 5%-6%, and the 60+ day delinquency rate was between 1.80% to 2.10% (these figures include both Freddie and Fannie Mae CRT mortgages).

Our analysis provided a few answers – but also prompted many more questions. One thing that’s for certain is, due to the wide variance in servicing performance, CRT Investors would do well to closely monitor the performance of the collateral underlying their positions.

[1] All data retrieved on June 23, 2020 from Freddie Mac’s website.

[2] “Freddie Mac Credit Protects $231 Billion of Single-Family Mortgages in 2019.” Freddie Mac, 18 February, 2020.

[3] “Freddie Mac Announces Enhanced Relief for Borrowers Impacted by COVID-19.” Freddie Mac, 18 March, 2020.

[4] Covid-19 CRT FAQs. Freddie Mac, 2020.

Oakleaf at a Glance

See Who We Are | Meet Our Leadership Team

Join The Oakleaf Team

Join Oakleaf and put your talents and skills to work with our leading financial, banking, and mortgage client organizations.

See The Work We Do

See how we support our clients and their teams in tackling their most complex matters. Or contact us if you want to discuss anything further.