Trusts with Increasing Delinquencies from March to April 2020

Trusts with Decreasing Delinquencies from March to April 2020

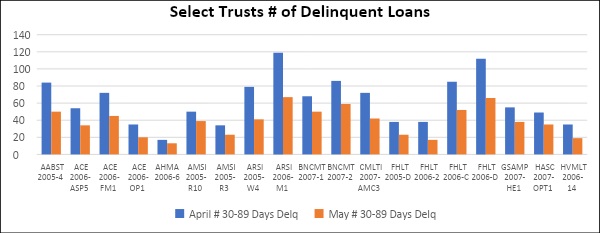

Shown below are 20 of trusts with decreasing delinquencies from April to May remittance reports (i.e., March to April loan activity).

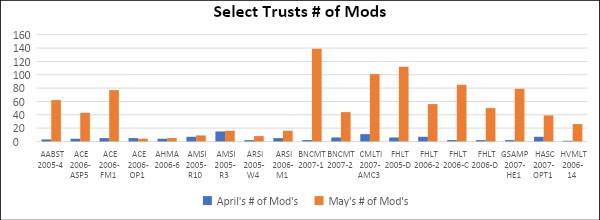

Below is the modification activity on the selected trusts

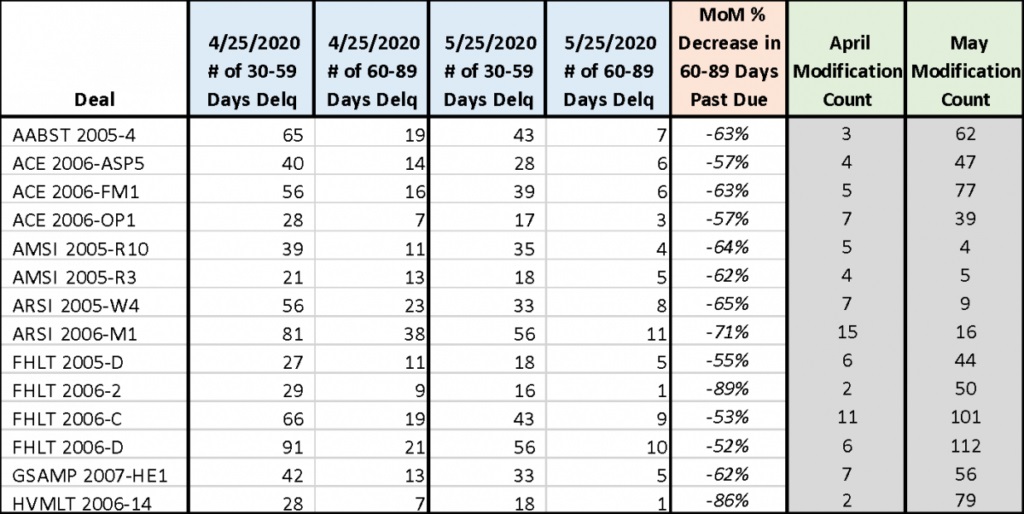

Below is additional information summarizing the delinquencies and modification activity on select trusts serviced by PHH Mortgage Corporation. As you can see the MoM 60-89 days delinquent loan count decreased substantially, and the modification activity increased exponentially in May.

According to PHH Mortgage website – customers who have experienced a financial hardship due to COVID-19, the following benefits are available:

– Payment forbearance with repayment options

– No negative credit reporting during this period

– Waiving late fees during this period

– Postponing the foreclosure sales process during this period

What happens at the end of the forbearance period? Potential options include:

– Forbearance period extension

– Lump sum payment

– Repayment plan

– Loan modification

We realize that we are in the very early stages of a potential W, U or V shaped recession and many of the economic indicators such as unemployment, mortgage rates, forbearance activity continue to be volatile. However, we will continue monitoring their impact on the mortgage market and provide future subject specific updates to keep you apprised of relevant market events.

Investors seeking assurance that their RMBS investments are being serviced correctly should contact Oakleaf Group for a portfolio review.

[1] “Share of Mortgage Loans in Forbearance Increases to 8.46%.” MBA, 1 June, 2020.

[2] “Share of Mortgage Loans in Forbearance Increases to 8.46%.” MBA, 1 June, 2020.

[3] “Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Falls for First Time Since Crisis Began; 8.9% of All Mortgages Now in Forbearance.” Black Knight, 5 June, 2020.

[4] “Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Falls for First Time Since Crisis Began; 8.9% of All Mortgages Now in Forbearance.” Black Knight, 5 June, 2020.

Oakleaf at a Glance

See Who We Are | Meet Our Leadership Team

Join The Oakleaf Team

Join Oakleaf and put your talents and skills to work with our leading financial, banking, and mortgage client organizations.

See The Work We Do

See how we support our clients and their teams in tackling their most complex matters. Or contact us if you want to discuss anything further.