Coauthored by Maclean Amlalo

The steps to collapsing an RMBS trust start with the trust’s eligibility. A trust qualifies for optional termination (“optional cleanup call” or “cleanup call”) when the balance of all remaining mortgage loans outstanding falls below a pre-specified threshold (generally between 5% to 35%) of the aggregate original mortgage loans’ balance. Percentages vary by trust.

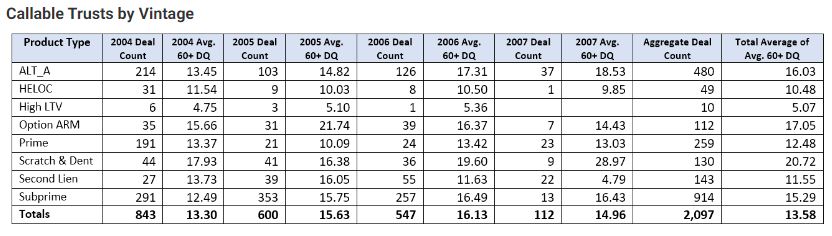

Based on a review performed by Oakleaf of the population of RMBS trusts originated from 2004 through 2007, the following status of trust eligibility for cleanup calls was observed: 96% of the 2004 vintage, 98% of the 2005 vintage, 69% of the 2006 vintage, and 26% of the 2007 vintage meet the eligibility criteria.

The timing, responsibility, and economics of exercising a cleanup call are set forth in the governing documents. If a trust is callable, the authorized party or parties (referred to as the Terminator) usually consist of one or more of the following entities: the servicer, the master servicer, the issuer, the residual holder, or the trustee.

Optional Termination of the Trust permits the Terminator to purchase the mortgage loans at their option, for their benefit or the benefit of a third-party investor. The mechanics of the termination process can vary significantly by trust. However, generally the funds received from the purchase of the underlying collateral are distributed to the certificate holders on the “final distribution date” of the trust.

Specific steps in the process include: 1) determining the purchase price and 2) valuing the real estate owned (REO) and potential collateral auction. Each step varies from trust to trust, and to this end, two examples are provided below.

Example One:

- Purchase Price: The greater of the aggregate purchase price of all mortgage loans or the aggregate fair market value of the assets (as determined by the Terminator and the Trustee).

- Value of the REO: The aggregate purchase price of all mortgage loans and appraised value of each REO property. The appraisal would be conducted by an appraiser mutually agreed upon by the Terminator and the Trustee in their reasonable discretion.

Example Two:

- Purchase Price: (i) 100% of the unpaid principal balance of each Mortgage Loan (other than in respect of REO Property) (ii) the lesser of the appraised value of any REO Property as determined by the higher of two appraisals completed by two independent appraisers selected by the Servicer at the Servicer’s expense.

In almost every case in which the purchase price is being determined, the REO population is required to be appraised. In the first example, the governing documents do not specify who the appraiser will be, whereas in the second example, the governing documents specify that the appraiser needs to be independent. The ambiguity surrounding the appraiser in the first example could have an economic impact on the call execution.

Some trusts require the collateral to be sold at auction under Auction Redemption procedures. The Master Servicer (or its agent) will solicit bids in a commercially reasonable manner for the purchase of the mortgage loans and other property of the Trust Estate. The issuer will sell the assets of the Trust Estate to the highest bidder provided the Master Servicer has received at least three bids from prospective purchasers (other than an affiliate of the depositor) and at least one bid is equal to the redemption price of the notes.

Some of the above language places the majority of the economics associated with the termination in the hands of the Terminator, which is typically the Master Servicer or servicer. What is omitted from many of the trust’s governing documents is an explanation of how to calculate the fair market value and/or the appraised value. This lack of guidance relating to some of the integral components driving the economic value of the underlying collateral could potentially create conflicts between the multiple roles assumed by the parties to the governing documents.

Optional Cleanup Call Economics / Obstacles

Based on our review, we have identified more than 1,000 trusts that are eligible to be called. This eligibility, combined with a robust housing market, presents optimum circumstances to execute a cleanup call. So why aren’t these deals being called? One explanation could be the existence of high percentages of non-performing loans in these trusts; collateral losses have eroded credit enhancement and resulted in significant certificate losses. Another explanation could be the presence of net interest margin (NIM) features tied to the primary deal which may require a Terminator to seek the NIM holder’s consent.

Optional Termination Eligible Trusts

Below is a summary of trusts that are call eligible by vintage / product type / 60+ day delinquent.

Most of the trusts have 60+ delinquencies in the mid-teens. Other deals with lower delinquencies are second lien deals which most likely still have limited equity, depending on the first lien and the value of the underlying property.

Stay tuned for our next post on this topic, where we will take a deeper dive into specific examples of called trusts.

Oakleaf at a Glance

See Who We Are | Meet Our Leadership Team

Join The Oakleaf Team

Join Oakleaf and put your talents and skills to work with our leading financial, banking, and mortgage client organizations.

See The Work We Do

See how we support our clients and their teams in tackling their most complex matters. Or contact us if you want to discuss anything further.